CashBus APK

v2.4.0

wise88cc

The CashBus APK is a mobile application that facilitates quick and convenient access to financial services, offering hassle-free cash loans and other financial tools.

CashBus APK

Download for Android

Are you in a pinch and need some quick cash? Maybe an unexpected bill popped up, or perhaps you’re just short on funds before payday. Whatever your reason, getting money fast can be stressful. But guess what? There’s an app that might help make things easier for you: The CashBus APK.

What is the CashBus APK?

The “APK” part of CashBus APK stands for Android Package Kit it’s like a box that contains everything needed to install an app on your Android phone. So when we talk about the CashBus app, we’re talking about a special tool designed to give people loans through their smartphones.

This digital lending platform offers a convenient way to apply for small personal loans without having to visit banks or fill out piles of paperwork. It’s made especially for those moments when time is tight and so are finances.

How Does It Work?

Using the CashBus app is pretty straightforward:

1. First thing first – download! You’ll have to get this application from online sources because usually, apps like these aren’t available on Google Play Store due to strict financial guidelines.

2. Install it onto your device by following simple instructions (make sure settings allow installation from unknown sources).

3. Open up the app and create an account using basic information such as name, address, contact details, etc., along with documents proving who you are (like ID proof).

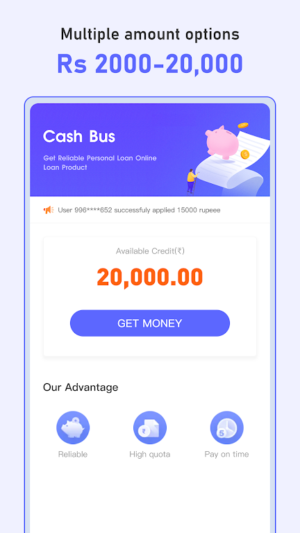

4. Decide how much money you want – there will likely be limits since this isn’t meant as a long-term loan solution but more of a quick fix until the next paycheck comes around.

5. Fill out any additional required info related specifically to why you need to borrow the said amount at the current moment in time; then submit the request to the review team behind the scenes at a company running the service itself.

6. Wait patiently while they check over everything and make sure all checks out okay- if does, congratulations because should receive approval notification shortly thereafter, followed by actual funds being sent directly to the bank account provided during the signup process!

7. Pay back the borrowed sum plus the interest fee once you reach the date agreed-upon originally signed contract and begin the whole cycle again in the future.

Why Choose CashBus?

Here are a few reasons why someone might pick CashBus over other options:

- Speed: Applications can often be processed quickly which means could potentially have access within hours depending situation specifics involved here.

- Convenience: No need to go anywhere physically do anything except tap away the screen, comfort your own home office wherever else happens find self day applying.

- Simplicity: The interface is user-friendly meaning shouldn’t run into many complications trying to navigate through the various steps outlined above either.

However, remember important always to read the terms and conditions carefully and understand fully the commitment entering into taking a loan regardless of size and duration thereof also, keep in mind rates and fees associated with borrowing vary greatly between different lenders including ones found via platforms similar nature mentioned herein today post.

Thus shop around a bit and do research before jumping headfirst decision based solely on convenience factors alone otherwise end up paying more than bargained beginning ultimately defeating the purpose sought after starting place namely easing financial burden and not adding another existing pile of worries and concerns already dealing life general speaking course.

Conclusion

Whether facing an emergency or simply looking to bridge the gap till the next influx of income arrives, consider giving try to see fits the needs of a particular scenario currently. Just remain cautious and aware implications come alongside decisions revolving around credit debt management overall!

Reviewed by: Najwa Latif

Ratings and reviews

There are no reviews yet. Be the first one to write one.